The patient financial experience - within and beyond the coronavirus (COVID-19) pandemic

How health systems and providers can improve their patients’ financial experience and help them find convenient, efficient ways to pay their bills.

By Synchrony, Health & Wellness in partnership with MGMA

Posted Sep 16, 2020 - 8 min read

A Perfect Storm

In many ways, the Coronavirus (COVID-19) healthcare emergency created the perfect storm for the American healthcare industry, straining resources and testing the resolve of both administrators and front-line health workers. It prompted providers to fast-track the adoption of telemedicine protocols, while simultaneously dealing with unprecedented budgetary shortfalls and staffing furloughs, as non-emergency visits and procedures ground to a complete halt.i

It has also highlighted the importance and necessity of the emerging wave of contactless electronic payment options such as Amazon Prime Now, Apple Pay, Walmart Pay and Venmo.ii These forms of contactless payments, already popular prior to the Coronavirus pandemic, have been skyrocketing “as people try to avoid person-to-person contact.”iii

The High Cost of Healthcare

The Coronavirus appeared in an environment where high-deductible healthcare plans mean nearly 24 million consumers already have exceptionally high costs for healthcare premiums and out-of-pocket costs, compared to their incomeiv, and where medical costs for a typical fourperson U.S. family on an employee-sponsored PPO total $28,385, including premiums and out-of-pocket costs.v The additional strain caused by the crisis points to the absolute necessity for healthcare providers to be proactive in streamlining the financial experience for patients. This will be especially important as more patients face their own personal financial issues as layoffs, furloughs and job losses impact their medical insurance coverage and their ability to pay for medical care.

A Low Margin Business and the New Normal

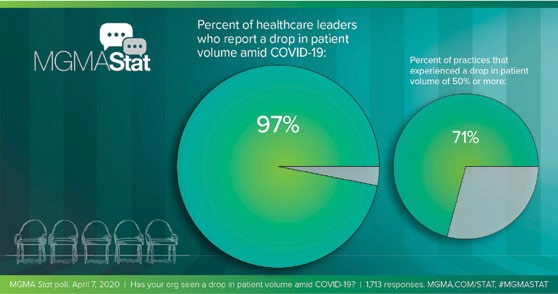

Jay Grider, chief physician executive for Kentucky’s UK HealthCare, noted that ER visits dropped more than 50% during the crisis and that surgeries were down 80% – resulting in more than $150 million in losses in his system alone, and more than 1,700 employees being placed on nopay status. As Grider told the Washington Post: “It shows the economic vulnerability when your health system is built on a low margin business. I don’t think anybody would have expected a medical crisis would result in a hardship for medical providers.”vi However, that’s exactly what has happened in light of the Coronavirus, with consumer spending on healthcare down 18% in the first three months of 2020.vii

As we begin the slow recovery from this disruption to the American healthcare system, what can leaders learn from the crisis? Especially as they continue to try to improve the patient financial experience and settle into a “new normal” that will likely see long-term modifications to the culture of in-person visits and hands-on medical care. What strategies can they employ in both adopting user-friendly technology to help patients better understand the costs of their care, as well as managing their accounts, accessing financing options or being offered payment plans to help cushion the blow of high out-of-pocket premiums and copays?

Quarantines and government-mandated social-distancing orders related to the Coronavirus may have been the incentive many providers needed to finally address remote care in a more direct manner and to more aggressively pursue ways to meet today’s consumers on their terms. But the crisis also illustrated the steep learning curve many providers face in adopting new technology, and in complying with rules governing its use. Practically overnight, clinics and outpatient services were put in the precarious position of switching to an entirely telehealthbased model.

This created its own set of major coding and billing challenges, especially as both the CMS and the AMA issued regulatory waivers, updates, and new visit and lab codes, practically on the fly. An MGMA poll conducted April 28, 2020, found this resulted in widely inconsistent payer rules, plus a struggle for providers to consistently document visits – leading to vast discrepancies in pay parity and accuracy.viii

Outdated Processes

According to InstaMed’s 2019 Trends in Healthcare Payments Report, 91% of patients say they received an unexpected medical bill in 2019. And on the provider end, it still seems like the pre-digital era: 88% of providers still rely on manual and paper-based transactions to collect balances, and 81% of payers still deliver paper checks to providers. As the report notes, while providers find that more and more of their revenue is derived from out-of-pocket payments directly from consumers, they “have not embraced the payment options that consumers overwhelmingly demand at scale and still depend on manual and paper-based processes for healthcare payments.” As a result, “the consequences of provider inaction take the form of... wasted spending and damages to brand trust and loyalty.” ix

Convenience is King

As providers prepare for the “new normal” post-pandemic, they will need to consider that patients have a desire for more convenient interactions with their providers, which has only grown in recent months. Five percent of American consumers reported that they or a family member used telehealth for the first time during the Coronavirus pandemic, and 88% of those new to telehealth reported they would use it again.x

As such, convenient features like telehealth consultations and contactless payments may become crucial for providers who want to provide positive patient experiences that can attract patients and build loyalty that can help sustain their practice.

Not only has 70% of our revenue disappeared, but our physicians are still working every day, exposing themselves to risk, taking care of patients, and taking care of their employees, while they have taken over a 50% pay cut.

Independent anesthesiology practice in Alabama, MGMA STAT, May 20, 2020

Consumer out-of-pocket spending grew to $376 billion in 2018.

The Centers for Medicare and Medicaid Services 2019 fact sheet

Consumer Burden

The shift from traditional employer-sponsored healthcare to high-deductible healthcare plans has also radically transferred the burden of financial management and budgeting for healthcare expenditures directly onto the consumer. According to the Kaiser Family Foundation’s 2019 Employer Health Benefits Survey, 82% of covered workers now have a deductible in their health insurance plan – up from 63% a decade earlier – with workers facing an average deductible of $1,655, a 162% increase in financial responsibility, in just a decade. Even before the Coronavirus pandemic, 73% of consumers said they were concerned about their ability to pay their medical bills, and 50% said they felt they were one sickness away from serious financial trouble.xi

By taking greater responsibility for cost of care, patients are playing a more active role in their healthcare decision-making. Patients may see their spending as an investment in their own health and wellness, and providers who assist with that investment could offer a better patient experience — and have a positive impact on the bottom line. Helping patients understand their financial responsibilities, including copays and deductibles, is an opportunity for practices to stand out. Patient care is no longer only about clinical outcomes; it’s also about helping patients plan and manage their financial obligations and providing options to make payments easier.

Finding Balance

Deidre Ruttle, vice president of strategy, InstaMed, said the focus for providers is striking a balance between quality patient experience and a smooth revenue cycle.xii “We believe you need to give consumers options to make payments, because they’re used to that experience when they pay their cell phone bills, their cable bills and other household bills,” she said. “When you give consumers convenience in healthcare, they use it. They take advantage of things likedigital wallets, automatic payments or payment plans. Why wouldn’t healthcare be like that?”

Ruttle said that educational outreach and even counselling for the patient financial experience are equally important, perhaps even more so in light of economic disruption caused by the Coronavirus. “The percentage of consumers who have gone to collections, received bills higher than they thought they would be, or were completely confused by bills – the numbers are staggering,” she said. “We absolutely have to think about the financial portion of the patient experience. We have to change the dynamic in terms of helping people understand, ‘What are my benefits? What is my total out-ofpocket maximum?’”

65% of consumers surveyed reported that they would consider switching providers after receiving an unexpectedly high bill.

CareCredit, Understanding the Medical Journey, August 2019

Sticker Shock

Receiving unexpected post-care bills is a significant point of stress for consumers, with 53 % of consumers surveyed admitting to feeling stress when receiving an invoice post care. In fact, 65% of consumers surveyed reported that they would consider switching providers after receiving an unexpectedly high bill.xiii

Narrower networks associated with high-deductible plans have also made it more difficult for patients to find in-network options for specialty services or discover that a referral from a physician’s office does not always come with a pricecheck guarantee. Wendy Hanson, support manager at the Nebraska Medicine hospital group, said that often results in sticker shock for patients, after the fact. “That becomes a very big problem, because they may come here, and they don’t quite realize that they’re not supposed to come here, and they’re going to be responsible for that entire balance,” she said. xiv

Hanson said her hospitals opted to put extra effort into formalizing cost estimates to improve transparency and they offer the service of financial counselors to screen patients and offer financial assistance options where possible. They have all so added a website and a portal that patients can use to check their balances, set up payment plans or ask questions of the customer service department. That’s been a radical change, she said. “Our scores are showing an upward trend. Patients’ confusion has reduced. We’re better at selling it. We’re better at talking about it. And we understand it better – and that just trickles down to the patient,” Hanson said. “When you have lots of options for a patient, it really gives them the feeling that you care about their future, their abilities and their health. They need to know that we’re not just some business. We’re here to care for them.”

TIPS for achieving happier patients:

- Utilize EHR assistance to clarify contracted/non-contracted services

- Verify patients’ insurance prior to service

- Educate patients on their financial responsibility and help them navigate potentially narrow networks with a team of specialized financial counselors

- Provide patients with cost estimates prior to service

- Utilize online cost estimator tools for services

- Wendy Hanson

Patient Payment Options

One sign of progress is that many providers are beginning to accept payment methods that they hadn’t offered before – a shift that began even before the sea change of the Coronavirus pandemic. “This shift makes it easier for consumers to pay for medical costs, and thus more likely to move forward with necessary care, as 43% of consumers surveyed admit that medical costs have caused them to delay, decline or discontinue care,” according to CareCredit Medical Journey Research. xv Also, a November 2019 MGMA survey found that 95% of respondents said they do not accept these other payment options, but cited PayPal, Apple Pay and the CareCredit credit card as the three most popular they do use.xvi

Trends in sharing money through apps such as Apple Pay, Venmo, Zelle and PayPal have continued to pick up speed — a recent survey estimated PayPal handled nearly $142 billion in person-to-person (P2P) transfers in 2018, while Zelle handled $122 billion in P2P transfers in the same year. Banks continue to be the preferred method of transferring money, with $172 billion in P2P exchanges, but they are no longer the only option for consumers. Currency sharing technologies are providing an easier way for people to manage their money — making their adoption for paying medical bills a logical step as patients continue to shoulder more out-ofpocket expenses.xvii

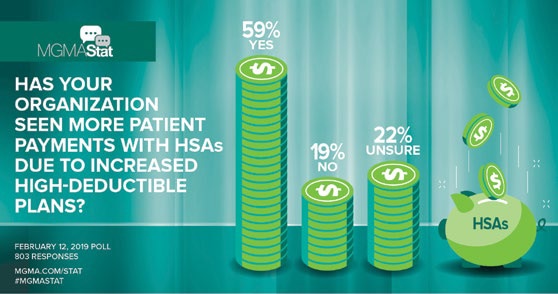

Providers also need to consider strategies and tools for helping consumers better manage their self-directed healthcare savings plans. There has been a surge of patient payments being made from their own HSA accounts, as more and more Americans use these to offset the costs of their high-deductible healthcare plans. A 2019 MGMA survey found that 59% of healthcare leaders had seen an increase in HSA payments.xviii As one respondent said, “It now sets expectations that patients will pay a portion of the deductible at time of service” to help improve collection of patient payments. Another participant outlined how their organization has adjusted: “We collect $60 from each patient who has a high deductible plan if they have not met the deductible … Then we bill, and if necessary, collect the difference … This helps with cash flow.”

Erin Gadhavi, senior vice president of strategy and initiatives at CareCredit notes that high-deductible healthcare plans have led many people to turn to health and wellness credit cards to help them pay for medical expenses over time.

“Dedicated health, wellness and personal care credit cards like CareCredit enable patients to pay for care without tying up their cash or general use cards that may be needed for other expenses,” notes Gadhavi. Consumers are looking for convenience and Gadhavi believes they can find that in health and wellness credit cards.

“This makes it easier for people to get the care they want and need, right when they need it, without having to delay treatment or appointments due to cost,” she says. “The ability to pay over time – even if just over six months – can make a significant difference to patients who need to pay for deductibles, copays, and treatments that aren’t covered by insurance or that exceed their HSA balance.”

From 2007-17:

Enrollment in high-deductible health plans (HDHPs) with a health savings account (HSA) increased from 4.2% to 18.9% among adults 18-64 with employment-based coverage; it increased from 10.6% to 24.5% for those without an HSA in that age group. Enrollment in traditional plans decreased. Enrollment in an HDHP with an HSA was higher among adults 30–44 (21%) than among those 18–29 (16.8%) and 45-64 (18.4%).

Source: National Health Interview Survey, NCHS Data Brief No. 317, August 2018

Case Study: Keep It Simple

Mona Reimers, director of administrative operations with Ortho NorthEast in Fort Wayne, Indiana, an orthopedic group with 90 practitioners and 300 staff, said the patient financial experience still hinges on simplicity, and predictability. (M. Reimers, personal communication, May 1, 2020).

“Patients want convenience, whether it’s convenient times for their appointments, telehealth or Saturday hours – that patient has become a consumer. And rightfully so, as oftentimes a lot of their own money is going toward the cost of their healthcare,” she said. “Patients want to be able to pay with Apple Pay, or they want to keep a credit card on file. People like being able to pay online from an electronic statement. Most people are joining the crowd by paying bills by telephone or on the web, so healthcare has to get on the bandwagon.”

Patients expect us to know about benefits before services are rendered

Mona Reimers

Director of Administrative Operations with Ortho NorthEast

It’s also a matter of “being proactive, identifying and reaching out to patients with high deductibles and copays, and making them aware of their expectations, especially if they already have a credit card on file.” Reimers suggested practice leaders should take time to think, and ask, before submitting high-dollar billing – even consulting with providers before services are scheduled.

“We started a policy that if a patient wanted to go on monthly payments, they had to leave a credit card on file, because it was too easy for our patients to miss a month. We had concerns about what patients would think, but in a year’s time, 500 people called to make payment plans, and followed through.”

Despite the advances, it’s still an imperfect model, Reimers admitted. “One major burden is that patients expect us to know about benefits before services are rendered,” she said. “But it is just literally impossible to calculate down to the penny what everyone’s going to owe prior to their visit or surgery, because there’s so many moving parts.”

97% of healthcare leaders report a drop in patient volume amid COVID-19.

Financial impact on Medical Practices: MGMA survey, April 7-8, 2020

Transparency Pays Dividends

A 2019 MGMA Stat poll asked healthcare leaders: “Does your organization provide cost estimates to patients for non-routine services?” The majority (68%) indicated “yes,” their organization provides cost estimates for nonroutine services to patients, while 27% responded “no”. Respondents who answered “yes” were then asked when cost estimates were provided to patients. More than nine in ten (91%) said their organization provides cost estimates before service is provided. A key takeaway from that research is that a lack of transparency leads to poor patient experience and directly affects practice operations and financial management. “Focusing administrative bandwidth on payment for service will continue to be important for the financial success of practices.”xix

Implementation, however, is still a work in progress. Although practices can deliver cost estimates, they often don’t take advantage of this opportunity. Despite almost 90% of providers stating they could supply cost estimates to patients, only 18% of patients received one without asking.xx Practices should consider implementing processes that ensure this critical information exchange happens more consistently.

Telehealth

After the disruptive experience of quarantines and intense social distancing of the early days of the Coronavirus pandemic, the long-term impacts of the virus may prompt a permanent change for many patients and consumers, who increasingly seek out the security and safety of telehealth and electronic scheduling – and be more interested in contactless payment and documentation methods.

The Coronavirus pandemic was ‘the nudge that the whole country needed’ to embrace expanded telehealth services and that the best care case is for improved management of patients with chronic conditions. Those patients were ‘rightfully scared about coming in’ to physician offices at the peak of the pandemic.

Mark Stephan, MD, MBA

Chief Medical Officer, Equality Health, April 2020

Mark Stephan, MD, MBA, chief medical officer, Equality Health, worked with a variety of small to mid-sized independent physician practices in mid-March, helping to set up rudimentary telehealth technology.xxi He noted that the Coronavirus pandemic was “the nudge that the whole country needed” to embrace expanded telehealth services and that the best care case is for improved management of patients with chronic conditions. Those patients were “rightfully scared about coming in” to physician offices at the peak of the pandemic. Ensuring these patients have an expanded means for check-ins and medical management activities will help protect them and a practice’s providers and staff members.

Access, either for telehealth services or to online/distanced financial services, also remains a challenge, and both providers and payers need to keep that in mind – a situation which escalated overnight during the Coronavirus pandemic. “It would be an understatement to say that my patients are lacking the latest technology,” a physician at a rural practice in Louisiana told MGMA. “Many of my patients do not have internet or smartphone access and do not have the technical expertise to add video messaging to their phones or home computers, even if their devices would be capable of adding such technology.”

It would be an understatement to say that my patients are lacking the latest technology.

A physician at a rural practice in Louisiana told MGMA, April 2020

Conclusion: an Action Plan for Providers

Getting your consumer-minded patients to be both participatory and proactive in their financial experience can be a simpler process if you follow these steps:

Define Your Patient-centric Financial Policies.

Before you can implement new policies, you need to define them. Consider what’s not working well. Are your patients confused about what they owe and facing unexpected healthcare expenses? Is your organization struggling to collect balances due? Answering these questions can help you identify where you may need to create new policies and processes to help your patients and your practice.xxii

Equip Staff to Be a Resource for Patients

In addition to offering estimates, organizations must be able to explain what the estimates mean and how much the patient owes at the time of service. When practices use approachable cost estimation technology that clearly communicates information, it makes it easier for staff to educate patients.xxiii

Make Payment Convenient

Given a choice, patients would opt to use debit or credit cards to pay, whether payment is made on the provider’s website, patient portal, via a credit card kept on file (CCOF) or with an automated payment plan. When providers present different options, patients can take advantage of whatever method works best for them.xxiv

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedReady to help more patients and clients get the care they want and need?

Get StartedReady to help more patients and clients get the care they want and need?

Get Startedi Price Waterhouse Cooper, The COVID-19 pandemic is influencing consumer health behavior. Are the changes here to stay? April 2020

ii Contactless payments surge amid COVID-19 — What this could mean for hospitals, Crone Consulting, https://www.beckershospitalreview.com/finance/contactless-payments-surge-amid-covid-19-what-this-could-mean-for-hospitals.html, April 2020

iii Ibid.

iv The Commonwealth Fund, How Much U.S. Households With Employer Insurance Spend on Premiums and Out-of Pocket Costs: A State-by-State Look, May 2019

v Milliman Research Report, 2019 Milliman Medical Index, July 2019

vi Historic financial decline hits doctors, dentists and hospitals — despite covid-19 — threatening overall economy, https://www.washingtonpost.com/business/2020/05/04/financial-distress-among-doctors-hospitals-despite-covid- 19-weighs-heavily-economy/, May 4, 2020

vii Price Waterhouse Cooper, The COVID-19 pandemic is influencing consumer health behavior. Are the changes here to stay?, April 2020

viii MGMA, Overcoming the top billing and coding challenges for telehealth and telephone visits during COVID-19, https://www.mgma.com/data/data-stories/overcoming-the-top-billing-and-coding-challenges-f, April 2020

ix InstaMed Trends in HealthCare Payments Tenth Annual Report: 2019

x MGMA, Overcoming the top billing and coding challenges for telehealth and telephone visits during COVID-19, https://www.mgma.com/data/data-stories/overcoming-the-top-billing-and-coding-challenges-f, April 2020

xi Kaiser Family Foundation, 2019 Employer Health Benefits Survey, https://www.kff.org/health-costs/report/ 2019-employer-health-benefits-survey/, September 2019

xiiMGMA, HIMSS19 practice insights: Deirdre Ruttle, https://www.mgma.com/news-insights/revenue-cycle/ himss19-practiceinsights-deirdre-ruttle, February 2019

xiiiCareCredit, Understanding the Medical Journey, August 2019

xivMGMA, Utilizing patient financing to drive patient experience https://www.mgma.com/resources/financialmanagement/utilizing-patient-financing-to-drive-patient-exper, January 2019

xvCareCredit, Understanding the Medical Journey, August 2019

xviMGMA, Are nontraditional payment options gaining a foothold in medical practices? https://www.mgma.com/data/ data-stories/are-nontraditional-payment-options-gaining-a-footh, November 2019

xviiZelle, Venmo. Venmo Versus Zelle: Who’s Winning The P2P Payments War? https://www.forbes.com/sites/ ronshevlin/2019/02/11/venmo-versus-zelle

xviiiMGMA, Increase in high deductible health plans contributing to increase in HSA payments https://www.mgma.com/data/data-stories/increase-in-high-deductible-health-plans-contribut, February 2019

xixMGMA, Providing cost estimates to patients to improve patient experience, https://www.mgma.com/data/datastories/providing-cost-estimates-to-patients-to-improve-pa, April 2019

xxMGMA, Improving patient financial communications, https://www.mgma.com/resources/financial-management improving-patient-financial-communications, August 2018

xxiMGMA, Medical practices innovate care delivery, increase telehealth access amid COVID-19,https://www.mgma. com/data/data-stories/medical-practices-innovate-care-delivery-increase, April 2020

xxiiMGMA, Are nontraditional payment options gaining a foothold, https://www.mgma.com/data/data-stories/arenontraditional-payment-options-gaining-a-footh, November 2019

xxiiiMGMA, Improving patient financial communications, https://www.mgma.com/resources/financial-management/ improving-patient-financial-communications, August 2018

xxivMGMA, Ibid.