Top 5 Best Practices for Talking About CareCredit

Help clients make informed care choices with flexible financing. Use this guide to promote CareCredit and show how easy, budget-friendly options can build loyalty.

By Synchrony, Health & Wellness

Aug 15, 2025 - 6 min read

Key Takeaways

- Promote CareCredit on your website, in patient communications and on marketing materials to let patients know you accept it as a payment option.

- Train your team to lead compassionate and informed cost conversations to help streamline the patient payment process.

- Sharing real stories and testimonials can help reinforce the value of flexible financing while showing how it supports patient satisfaction.

Your patients or clients want to be able to make health and wellness choices on their own terms. By driving awareness around the CareCredit credit card, you can remind them that you offer the flexible, friendly financing options that can help them fit health and wellness into their budget, while making it easy to choose you and return again and again.

Now’s the time to get started. Use this guide to communicate the benefits of CareCredit. We have the tools, tips, training and resources you need to help:

- Foster additional loyalty

- Help patients and clients learn about and apply for financing

- Make cost conversations easier

- Reach more patients and clients

We've included marketing tools such as adding CareCredit to your website, integrating financing into billing and appointment reminder emails and using marketing materials and collateral. We've also included provider tools such as leading confident cost conversations with tips and training and sharing testimonials and success stories.

Read on to learn more about how to incorporate CareCredit into your health and wellness practice, or download the guide for your team to have on hand.

To access many of the tools and resources in this guide, you will need to be logged into the Provider Center. If you need assistance with your login credentials, call 1-800-859-9975.

1. Add CareCredit to Your Website

According to CareCredit Path to Care Findings, 62% of patients surveyed research cost/fees when researching a procedure, and 36% of consumers said they research financing options.1

By featuring a dedicated financing page on your website, you can make it easy for patients or clients to know that you offer flexible financing options to pay for their treatment or care. Plus, the page could help them learn about CareCredit, see if they prequalify and apply all on their own.

We have what you may need to get started, including:

- Digital banners

- Logos and buttons

- Prewritten messaging

- Videos

Tips for your financing page

Here are two tips to help your patients or clients understand how CareCredit can help them pay for the care they want or need:

- Use prewritten messaging. Utilize prewritten content from the Provider Center to clearly explain how the CareCredit credit card works and its benefits, including prequalification, with no impact to the patient's or client's credit score. Download the prewritten messaging.

- Include educational videos. Adding videos that educate patients on CareCredit and how it works helps them to visually understand its value and benefits. Watch the video:

Example landing page:

2. Integrate Financing Into Billing and Appointment Reminder Emails

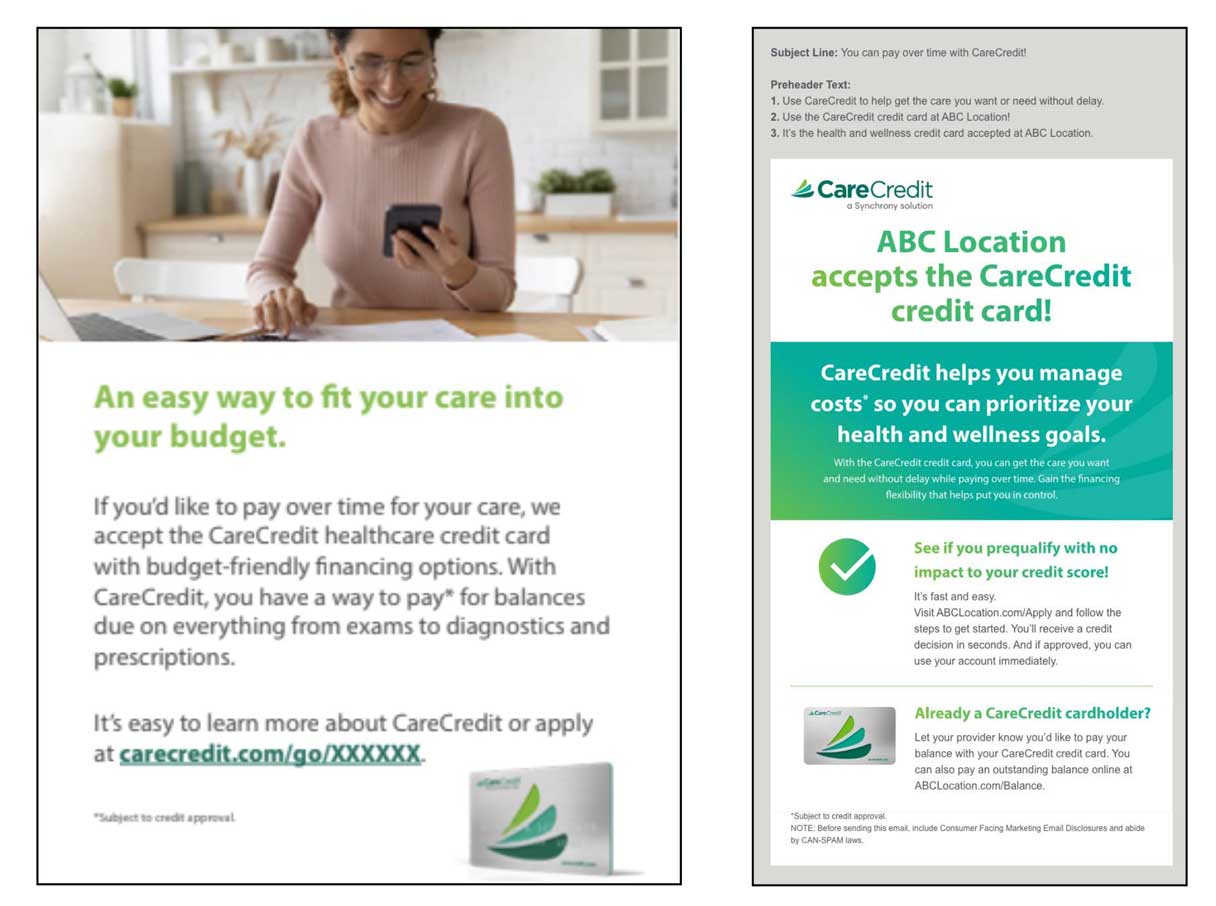

By incorporating CareCredit as a flexible financing option throughout the care journey, you can simultaneously help reduce cost concerns and decrease accounts receivable.

- Include your location's custom link. This URL is unique to your practice and allows patients or clients to learn more about CareCredit, see if they prequalify, apply and — if approved — pay all in one place.

- Copy and paste. Use prewritten messaging. Here's a sample:

- "Pay over time for healthcare costs. [ABC Location] now accepts CareCredit, the healthcare credit card, as a flexible, convenient way for you to pay over time for expenses not covered by insurance. See if you prequalify without impacting your credit score, or apply online today. Subject to credit approval."

How to incorporate CareCredit

Incorporating CareCredit into your billing and appointment processes doesn't have to be challenging. Here are a couple of ways to do so:

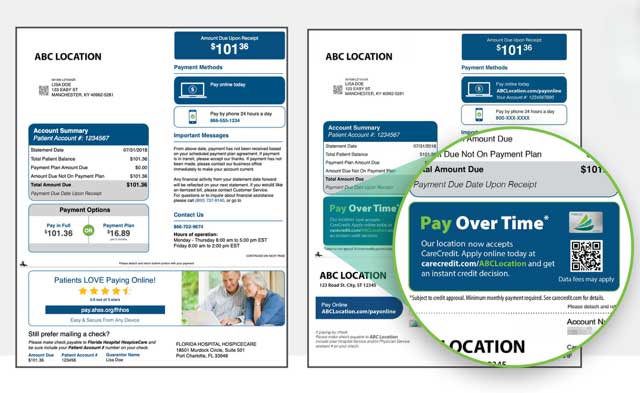

- Billing statements. Include our ready-to-use messaging on billing statements as a friendly reminder and to help make cost conversations easier. You can also order QR code stickers through the Provider Center and add them to billing statements when collecting payment.

- Emails and billing portal. Include messages in emails to patients or clients with account balances to let them know CareCredit is available to help make payment easier. Utilize prewritten messaging from the Provider Center or ask your sales contact for more approved resources.

3. Use Marketing Materials to Easily Create Awareness

Displaying signs, brochures and other marketing materials throughout your location is a great way to share the benefits of the CareCredit credit card and remind individuals of their options. When you include your custom link and QR code, your patients or clients can learn more, see if they prequalify, apply and, if approved, pay — all from their own device.

Plus, this friendly solution helps you save time since you can review applications and payment status directly in the Provider Center.

Order your free materials now at carecredit.com/ordersupplies. Then place the signage in prominent areas at your location, such as:

- Check-in desk

- High-traffic areas

- Waiting rooms

How to order marketing materials

You can choose from a variety of free marketing materials, including:

- Brochures

- Counter mat

- Signage

- Sticker sheets

We’ll take you step-by-step through the process to get your custom materials ordered and shipped directly to you:

To start your order:

- Visit carecredit.com/ordersupplies

- Click "Order QR code marketing materials"

- Select materials and send to print

4. Lead Confident Cost Conversations With Tips and Training

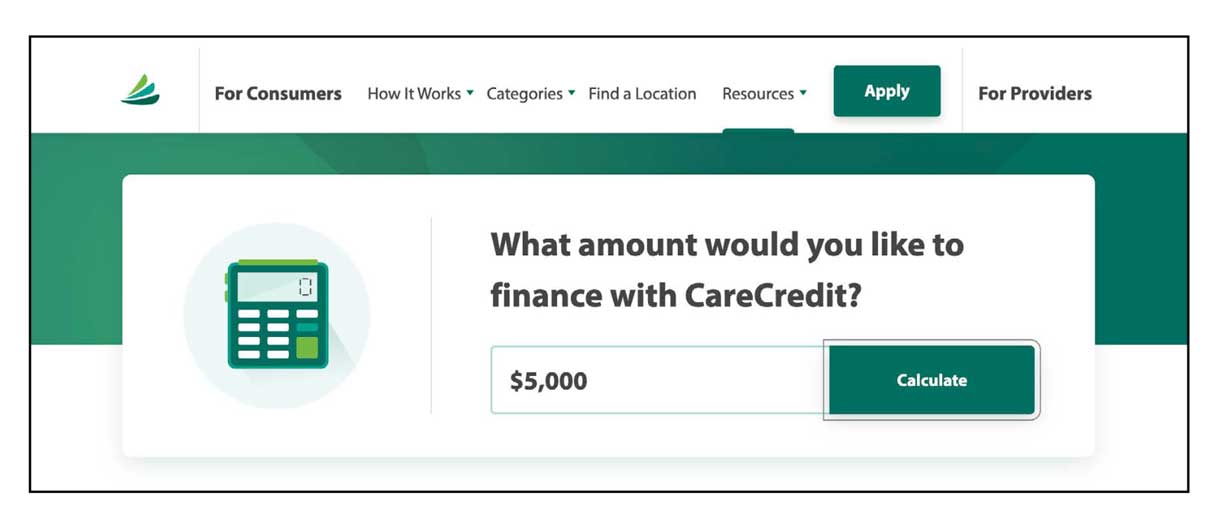

Did you know 62% of patients or clients surveyed said offering a variety of payment options is important when selecting a provider?1 The good news is you can help patients or clients feel empowered from the start to move forward with the care they want and need.

How you talk about financing can make the difference:

- Tips and scripts. Get examples and sound bites to help you and your team begin a helpful financial conversation.

- Payment calculator. Help patients or clients estimate monthly costs and see how CareCredit can help fit health and wellness into their budget.

Make the most of your training materials

Use these training tools to better support both you and your patients or clients:

- Digital book. This comprehensive training resource covers a wide range of topics, from dispute management to accessing reports on cardholders’ available credit; it includes helpful job aids along with orientation and operating guides.

- "New to CareCredit" learning resources. These detailed job aids, guides and videos empower new providers to confidently manage the CareCredit program in their practice. (California providers click here. All other providers, click here.)

- Instructional videos. This library of videos helps educate providers on topics such as ways to apply, benefits of the CareCredit credit card, clear financial communication and understanding promotional financing.

Live, virtual skills training

If you’re interested in live, virtual skills training, please reach out to your sales representative to learn more.

5. Share Testimonials and Success Stories

As a CareCredit provider, you can help inspire others and demonstrate your commitment through examples of how the CareCredit credit card has helped you, your practice and your patients or clients.

You can also encourage patients or clients to share their experiences with CareCredit, which could be featured on our website and inspire others to get the care they want or need. Let them know they can submit their story at carecredit.com/reviews/.

We’d love to hear from you, and we’re excited to do our part to help you continue to grow.

Offer Flexible Financing at Your Practice

If you are looking for a way to connect your patients or clients with flexible financing that empowers them to pay for the care they want and need, consider offering the CareCredit credit card as a financing solution. CareCredit allows cardholders to pay for out-of-pocket health and wellness expenses over time while helping enhance the payments process for your practice or business.

When you accept CareCredit, patients or clients can see if they prequalify with no impact to their credit score, and those who apply, if approved, can take advantage of special financing on qualifying purchases.* Additionally, you will be paid directly within two business days.

Learn more about the CareCredit credit card as a financing solution or start the provider enrollment process by filling out this form.

Ready to help more patients and clients get the care they want and need?

Get StartedReady to help more patients and clients get the care they want and need?

Get Started*Subject to credit approval.

The information, opinions and recommendations expressed in the article are for informational purposes only. Information has been obtained from sources generally believed to be reliable. However, because of the possibility of human or mechanical error by our sources, or any other, Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) does not provide any warranty as to the accuracy, adequacy or completeness of any information for its intended purpose or any results obtained from the use of such information. The data presented in the article was current as of the time of writing. Please consult with your individual advisors with respect to any information presented.

© 2025 Synchrony Bank.

Sources:

1 CareCredit Path to Care Findings, 2022. (CareCredit is a Synchrony solution.)