5 Ways You Can Build Healthy Financial Relationships with Horse Owners

Follow these strategies to help your clients better prepare for the cost of their horses’ veterinary needs over a lifetime.

By Synchrony, Health & Wellness

Nov 19, 2024 - 2 min read

As an equine veterinarian, you signed up to care for the well-being of horses. But this role isn’t just about keeping horses physically healthy. When you cultivate healthy financial relationships with horse owners, you help prepare them for a lifetime of equine care. This can help lower their anxiety about the high price tags that come with horse ownership.

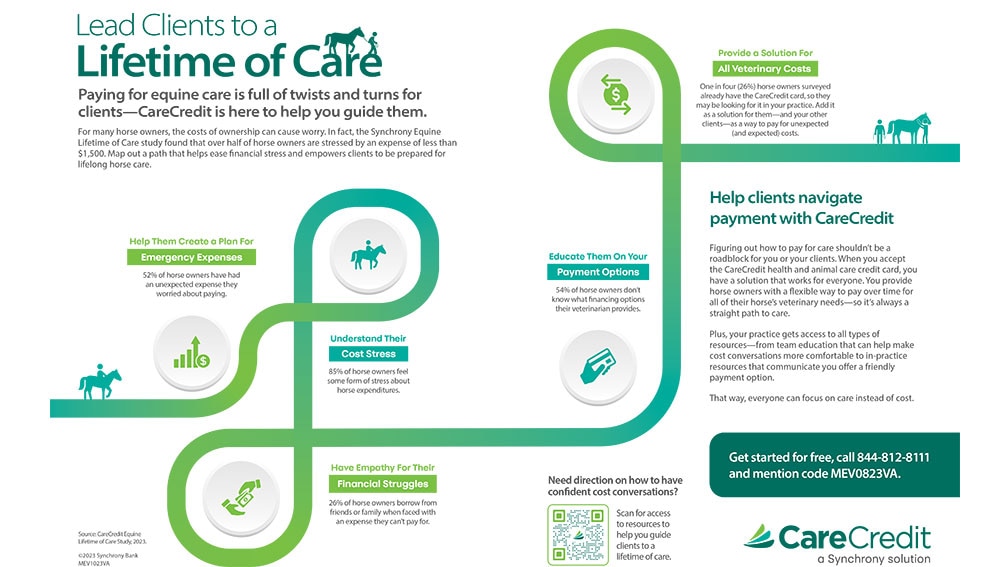

Here are five ways you can help build and maintain healthy financial relationships with your clients, supported by findings from the Equine Lifetime of Care Study.

1. Educate Clients on the Lifetime Cost of Horse Ownership

The basic cost of keeping a horse for a lifetime ranges from $215,000 to $575,000, depending on the role of the horse (competitive, recreational or backyard/pastured).1 Educate clients about these costs, helping them understand the financial commitment involved in horse ownership. This transparency can prepare owners for future expenses and foster trust in the veterinary-client relationship.

2. Encourage Financial Preparedness

Eighty-three percent of horse owners say they feel prepared for the expenses of ownership, yet only one-third have a dedicated savings plan for horse expenses.1 Encourage clients to create a financial plan for their horses. This could include setting aside funds for routine care, emergency situations and long-term expenses.

3. Offer Payment Options

Since 65% of surveyed horse owners indicated they would use a credit card for horse expenses, consider offering a variety of payment options, including a financing option like the CareCredit health and animal care credit card. Having this flexibility can make it easier for owners to manage their expenses and help ensure timely payments for your practice.

4. Tailor Communication to Generational Differences

The survey also revealed generational differences in how horse owners view and manage their expenses. For example, millennials are more likely to use a credit card, while Gen Z and older generations prefer cash.1 Understanding these preferences can help you communicate more effectively with clients of different ages and encourage financial preparedness across all generations.

5. Implement Clear Billing and Payment Policies

Establish and communicate clear billing and payment policies to your clients. This includes providing detailed invoices that break down the costs of services, explaining payment terms and setting expectations for payment at the time of service. Being upfront about your financial expectations can reduce misunderstandings and increase the likelihood of on-time payments.

By implementing these strategies, you can start to build healthy financial relationships with your clients. Financially prepared clients are empowered to say “yes” to the care their horses need throughout their lifetime, with less stress and a stronger bond to your practice.

Read more about the Equine Lifetime of Care Study and learn how to prepare horse owners for the cost of care.

A Flexible Financing Solution for Your Equine Veterinary Practice

Looking for a way to give your clients a flexible way to pay for care throughout their horse's lifetime? Consider offering the CareCredit credit card as a payment option. CareCredit allows horse owners to pay for equine veterinary services over time while helping to enhance the payments process for your practice.*

When you accept CareCredit, clients can see if they prequalify with no impact to their credit score, and those who apply, if approved, can take advantage of special financing on every qualifying purchase.* Additionally, you will be paid directly within two business days.

Learn more about the CareCredit credit card as a veterinary financing solution or start the provider enrollment process by filling out this form.

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedReady to help more patients and clients get the care they want and need?

Get StartedReady to help more patients and clients get the care they want and need?

Get Started*Subject to credit approval.

The information, opinions and recommendations expressed in the article are for informational purposes only. Information has been obtained from sources generally believed to be reliable. However, because of the possibility of human or mechanical error by our sources, or any other, Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) does not provide any warranty as to the accuracy, adequacy, or completeness of any information for its intended purpose or any results obtained from the use of such information. The data presented in the article was current as of the time of writing. Please consult with your individual advisors with respect to any information presented.

© 2024 Synchrony Bank.

1 "Equine Lifetime of Care Study," Synchrony. Accessed November 14, 2024. Retrieved from: https://www.equinelifetimeofcare.com/