Episode 5: Handling Financial Conversations With Patients Like a Pro

Patient financing discussions feeling awkward? Turn pricing talks into rapport-building opportunities. Learn to share the benefits of investing in vision care treatments through financing and grow your ophthalmology practice.

By Sarita Harbour

Digital Writer

Aug 29, 2025 - 23:00 min video

Patient communication isn’t always easy. In fact, discussing payment options for ophthalmology services can be downright uncomfortable. Yet, when handled well, these financial conversations can build trust, foster better acceptance of treatment recommendations and help your ophthalmologist practice grow.

In a recent webinar, “Handling Financial Conversations Like a Pro,” Troy Cole of the E3 Conversion System and digital marketing strategist Michael King shared valuable insights on how ophthalmological practices can approach patient financial communication with transparency, empathy and strategic patient engagement.

“Price is only an issue in the absence of value,” Cole says. This simple yet powerful mindset shift can help transform how your team addresses patient pricing questions, turning cost from a point of tension into an opportunity to educate and build rapport. (00:00:48)

Find out more about key areas your ophthalmology practice can focus on to help improve financial conversations with patients.

Communicate Value to Reduce Price Sensitivity

While patients may initiate the financial conversation by asking about costs, they may not realize the lasting value of investing in vision care services compared to the ongoing costs of glasses or contact lenses.

When patients understand the value, they focus less on price. To communicate value:

- Shift conversations from cost to health investment

- Position price in terms of long-term improved quality of life

- Use simple analogies, such as comparing vision correction to other meaningful investments

- Train your team to confidently explain why your pricing reflects comprehensive, high-quality ophthalmology care

As Cole explains, “What we charge allows us to do what we do without cutting any corners.” That confidence radiates from staff to patients and helps set realistic expectations. (00:2:45)

When and How to Talk Price

While transparency is important, sharing price information too early can lead patients to focus solely on cost without fully understanding the value of the treatment. When a patient asks about the price, King notes, you don’t always need to give them a number immediately. (00:11:04)

To manage timing:

- Build rapport and gather information about the patient’s needs to optimize the patient’s journey before discussing price.

- Use questions to better understand their concerns and tailor an explanation that reduces anxiety about investing in the treatment.

- For complex eye surgery financing options (e.g., refractive lens exchange), share educational content such as videos that explain the procedure, benefits, insurance coverage and financing options before sharing the costs.

- Take control of the conversation. Cole likened this to a 911 operator taking charge. “There’s not a single lead your team's going to reach out to that hasn’t reached out to you first,” and raised their hand asking for help. (00:09:10)

Help patients make informed decisions — rather than choosing solely based on sticker price — through a well-paced conversation.

Financing Options and Fitting Treatment Into Budgets

Affordability and costs create barriers to care, possibly preventing patients from pursuing vision treatment they want and need. Patients rarely pay large healthcare costs upfront; yet Cole points out that we typically finance major purchases like cars or phones. Elective vision care should follow the same pattern. (00:15:06)

Practical tips for discussing financing with your patients can include:

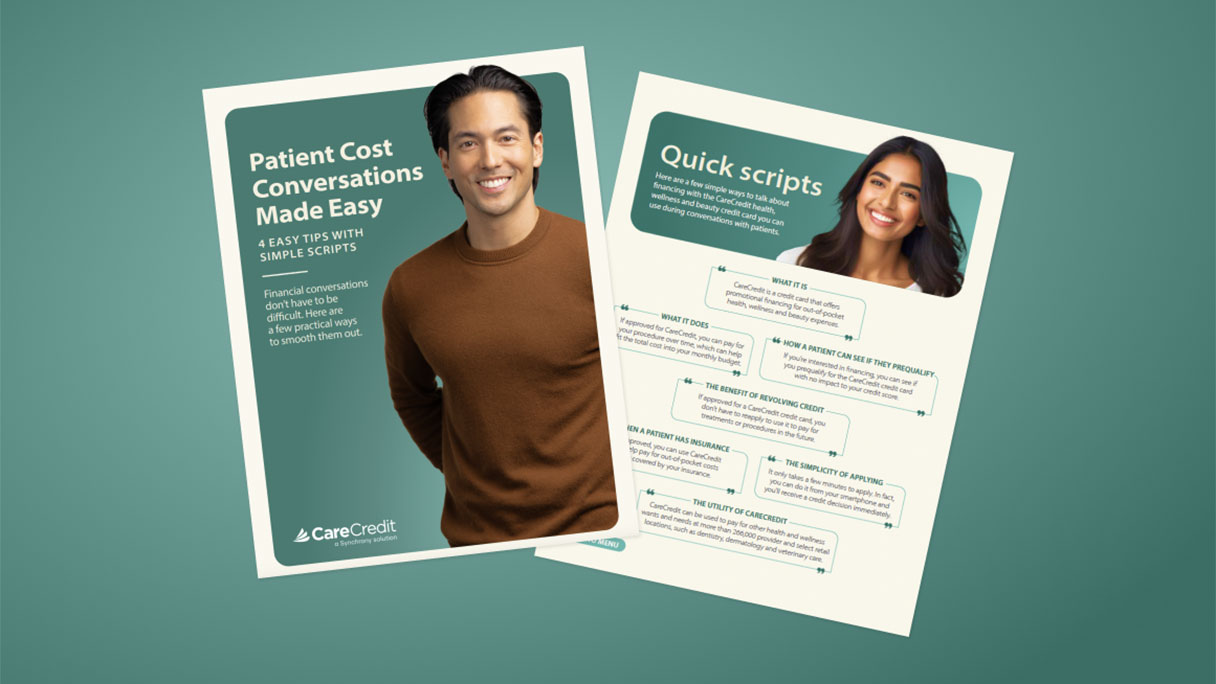

- Introducing the CareCredit credit card and payment plans you offer early as options to fit monthly budgets

- Focusing conversations on manageable monthly payments rather than lump sums

- Encouraging creative financing combinations, such as using credit cards, FSA funds and loans

Finally, train your team and invest in coaching to desensitize staff to pricing questions. Use scripting and role-playing, which helps staff approach the conversation naturally and empathetically.

As Cole says, “You want your staff to be desensitized to these pricing questions.” Practicing pricing conversations helps staff become comfortable discussing finance. (00:18:09)

Mindset, Messaging and Empathy in Patient Engagement

Keep vision care financing conversations straightforward and supportive. With the right mindset and skills, your ophthalmology practice can build trust, demonstrate value and empower patients to make informed decisions with confidence. (00:17:27)

Final takeaways:

- Mindset is everything. Be proud and transparent about pricing because it reflects the quality and outcomes you deliver.

- Educate patients. Help them understand how treatments differ and why certain options might better suit their needs. Guide patients through decision-making before answering price questions.

- Practice. Role-play financial conversations regularly to build team confidence and empathy.

- Get creative. Help patients afford vision care through flexible patient financing options and personalized plans.

Learn More: Watch the full webinar above for tips on building value and mastering patient financing and eye surgery financing options, specifically for ophthalmology providers.

A Patient Financing Solution for Ophthalmologists

Cost may be a barrier to care for your current and prospective ophthalmology patients. You can help them manage the cost of the care they want or need by offering the CareCredit credit card as a financing solution. CareCredit allows patients to pay for their eye exams, LASIK, surgeries and other treatments over time while helping to enhance the payments process for your practice.

When you accept CareCredit, patients can see if they prequalify with no impact to their credit score, and those who apply, if approved, can take advantage of special financing on qualifying purchases.* Additionally, you will be paid directly within two business days.

Learn more about the CareCredit credit card as a patient financing solution for your ophthalmology practice or start the provider enrollment process by filling out this form.

Author Bio

Sarita Harbour is a freelance writer with more than 15 years of experience covering personal finance, consumer banking, small business banking and credit for online audiences. Her work has appeared on sites such as Forbes, TIME/MONEY, MSN, The Motley Fool, First Horizon Bank, Investopedia and more.

Ready to help more patients and clients get the care they want and need?

Get StartedReady to help more patients and clients get the care they want and need?

Get Started*Subject to credit approval.

The information, opinions and recommendations expressed in the article are for informational purposes only. Information has been obtained from sources generally believed to be reliable. However, because of the possibility of human or mechanical error by our sources, or any other, Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) does not provide any warranty as to the accuracy, adequacy or completeness of any information for its intended purpose or any results obtained from the use of such information. The data presented in the article was current as of the time of writing. Please consult with your individual advisors with respect to any information presented.

© 2025 Synchrony Bank.