5 Ways to Help Improve Revenue Cycle Management

Revenue cycle management (RCM) is critical for health and wellness providers. Implementing RCM best practices could help you improve your patient experience and stay financially healthy.

By Maureen Bonatch

Posted Sep 20, 2024 - 7 min read

Identifying, collecting, and managing revenue starts with the initial patient contact and continues through the final collections for services — and it’s critical to your financial performance. Many providers have had to take a closer look at their revenue cycle management (RCM) due to shrinking reimbursements, higher deductibles, value-based reimbursement, and increased patient responsibility.

Front-office tasks, such as scheduling and registration, and back-office tasks, such as clinical care, coding, and billing, contribute to effective RCM. Manually completing tasks leaves room for mistakes that may result in delayed or decreased reimbursement. Implementing RCM best practices, on the other hand, could help improve the patient experience while boosting your financial health.

Why Revenue Cycle Management is Important

Examining RCM and following RCM best practices can help you manage your revenue cycle performance rather than allowing claims to control your financial viability.

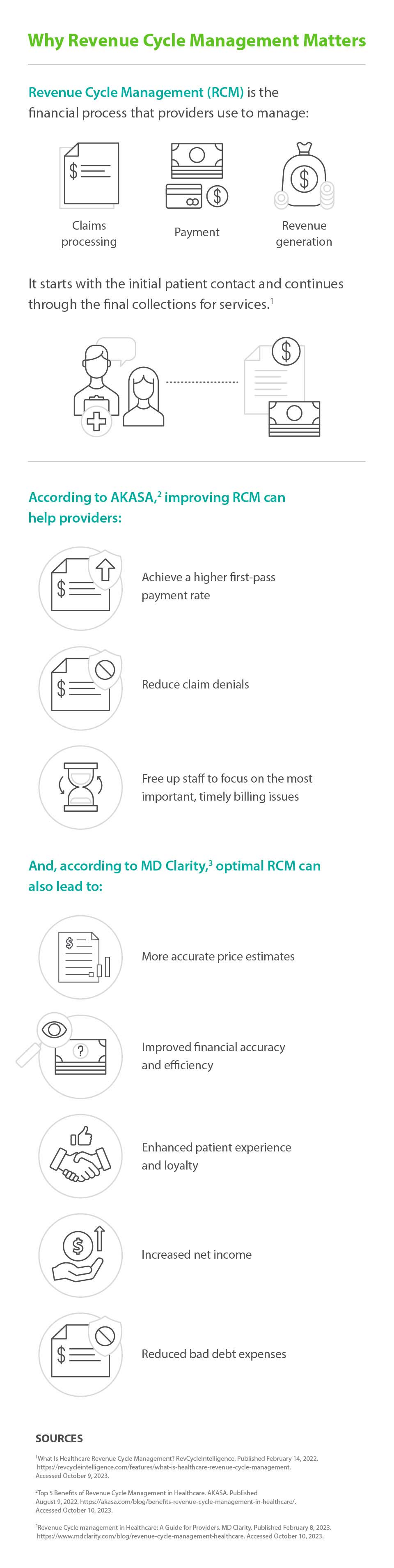

Improving your RCM can help providers:

- Achieve a higher first-pass payment rate

- Reduce claim denials

- Offer more accurate price estimates

- Improve financial accuracy and efficiency

- Enhance patient experience and loyalty

- Increase net income

- Reduce bad debt expenses

- Free up staff to focus on the most important, timely billing issues

How to Improve Revenue Cycle Management

To help improve revenue cycle performance, you can measure your performance and take other steps to determine benchmarks, track the revenue cycle, and identify positive revenue movement and areas that need adjustments.

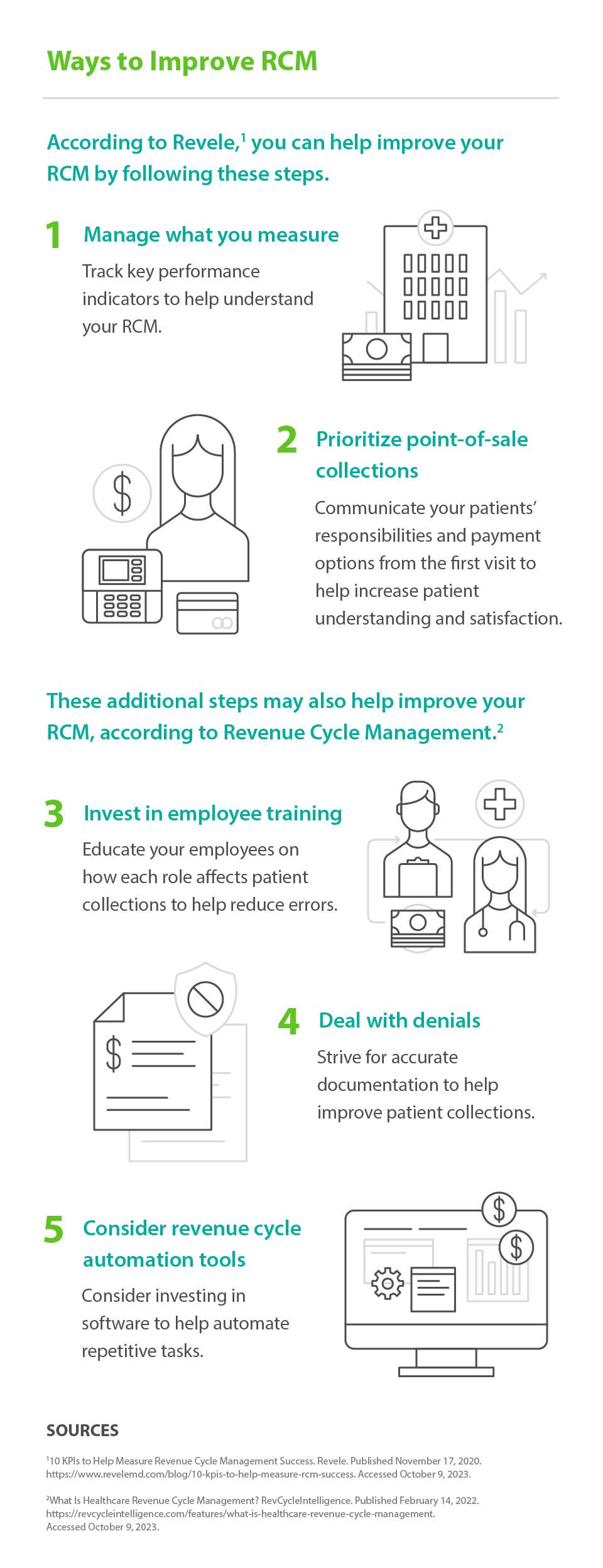

1. Manage what you measure

You can track key performance indicators (KPIs) to understand your RCM. The KPIs you decide to track will depend on your goals. Consider tracking these KPIs, which are closely related to RCM.

- Point-of-service (POS) cash collections refer to payments received at the point-of-service and up to seven days after. To determine this KPI, divide those payments by the total self-pay cash collected.

- Clean claim rate is the average daily number of claims that don’t require editing compared to the total number of accepted claims.

- Days in accounts receivable (A/R) focuses on the average time it takes to get paid for services and helps determine the effectiveness of reimbursement for services and managing account receivables. To find this KPI, divide the total A/R by the average daily net patient service revenue.

- Days in total discharged not final billed (DNFB) shows the impact on cash flow from claims inputting and issues related to delayed claims. Divide the total dollars in DNFB by the average daily gross patient service revenue to identify the KPI. A higher rate may indicate that you submitted claims incorrectly.

- Bad debt displays the effectiveness of collection efforts. Higher bad debt may indicate inefficiency in early areas of the revenue cycle, including POS collections and financial counseling. Calculate this KPI by dividing bad debt from the income statement by gross service revenue over a set period.

You may also want to track these additional KPIs.

- Cash collections as a percentage of net patient service revenue tracks your ability to convert net patient services revenue to cash. To find this KPI, divide the total collected POS cash collections by the average monthly net patient service revenue.

- Net collection percentage confirms accurate posting of adjustments and shows that accounts are collected or appealed rather than written off. To calculate it, subtract refunds from total receipts and then remove contractual adjustments. Then divide the first value by the second.

- Cost to collect measures efficiency and productivity. To calculate this KPI, divide the total revenue cycle cost by the total cash collected.

- Resolve rate explains the overall effectiveness of the RCM process. Divide the total number of claims paid for a defined period by the total number of claims to find this KPI. A higher percentage is better.

2. Prioritize point-of-sale (POS) collections

The patient has always been at the center of health and wellness, and this principle shouldn’t be any different for patient collections. As patient responsibility for the cost of care continues to grow, many patients may be unaware of how much they owe or struggle to afford high deductibles. It can be helpful to strive for a careful balance of identifying costs, communicating costs, and collecting early fees to help your patients meet their responsibilities.

Consider exploring these strategies to increase patient satisfaction, expand awareness about financial responsibilities and payment options, and ultimately, increase POS collections.

- Provide a thorough explanation of what to expect from the visit.

- Review coverage options with uninsured patients.

- Confirm health and wellness history, demographics, and insurance information early to reduce claim denials and expedite reimbursement.

- Revalidate insurance information with subsequent visits to avoid eligibility denials.

3. Invest in employee training

Employees in the health and wellness space have different priorities than patients and providers and are often only familiar with their part of the revenue cycle. This segmented process may be due to a lack of understanding when it comes to the combination of tasks results in complete payment. Additionally, according to the 2022 CAQH Index, new and different systems may make it even more challenging to get the job done — especially without the proper training.

You can foster employee teamwork and collaboration by educating your staff on how each role affects patient collections. Fill in any necessary knowledge gaps to help create more seamless, accurate, and faster reimbursement. Consider offering mentoring and training on RCM best practices related to:

- Billing forms

- Coding

- Chart documentation

- Revenue cycle software

- Insurance verification

Educational opportunities may allow for a better understanding of the role each person plays in your financial success and may improve efficiency while reducing claims denial.

4. Deal with denials

Early identification of errors can save time for your billing team. To avoid pushbacks instead of payments, help ensure claims are as clean as possible. Accurate documentation helps improve patient collections since denials can be prompted by:

- Missing information or misspellings

- Incorrect demographics

- Duplicate claim submission

- Coding complexities

- Miscommunications

Using a manual process increases opportunities for human error and may take more time to manage data successfully. It can result in lost revenue and increased demand on the administrative staff’s limited time, too. Automation, on the other hand, may help identify denials and the reasons behind them.

5. Consider revenue cycle automation tools

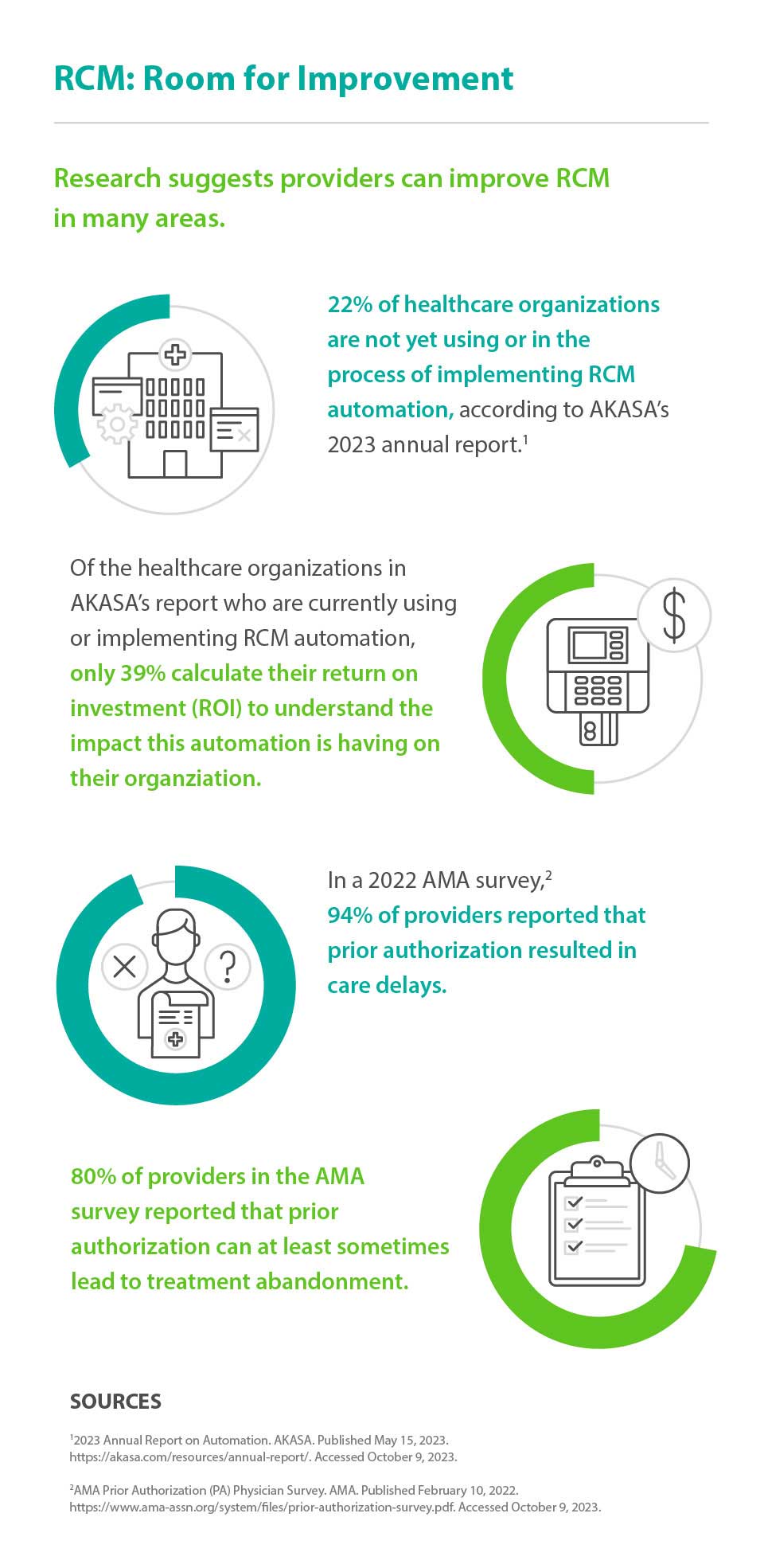

More than one in five healthcare organizations are not yet using or in the process of implementing RCM automation, according to AKASA’s 2023 annual report. And of the those who are currently using or implementing RCM automation, only 39 percent calculate their return on investment (ROI) to understand the impact this automation is having on their organization.

For the remaining 78 percent who have committed to automation, more streamlined RCM processes can not only save time, but also improve providers’ bottom line. In fact, according to a 2022 CAQH study, streamlining administrative processes with automation saved the healthcare industry $187 billion in 2021.

Focusing on improving efficiency by automating repetitive tasks may help improve RCM. Coordinating communication can reduce lost paper documentation and allow employees to focus on more complex, high-priority tasks such as collections, services to be billed, timely filing of claims, and insurance deadlines.

RCM software can usually stand alone or may integrate with Electronic Health Records (EHR) and may help automate repetitive tasks such as:

- Validating eligibility status

- Clearing patients before their appointment to reduce rework and potential denials

- Following up on claim status

- Creating patient statements

- Automating appointment and payment reminders

Tracking claims after submission may help determine the cause of pending, rejected, or denied claims and reduce recurrences. Switching to an automated process for prior authorization and coverage eligibility may reduce unnecessary costs. Plus, it may also have other benefits. In a 2022 AMA survey, 94 percent of doctors reported that prior authorization resulted in care delays and 80 percent said prior authorization can at least sometimes lead to treatment abandonment. Automating the process could lead to fewer delays in patients getting the care they want or need.

Revenue Cycle Management Improvement

Investing in automation may help you stay current with diagnostic codes and payer requirements and save time investigating unpaid claims or resubmissions, providing more time for other tasks, faster reimbursement, and fewer denials. Additionally, implementing RCM best practices can help you keep pace with the rapid changes in the evolving health and wellness industry.

About the Author

Maureen Bonatch MSN, RN

Maureen Bonatch MSN, RN draws from roles in nursing leadership, education and psychiatric nursing to write healthcare content. Her extensive experience in recruitment, procedural development, and retention tactics contributed to the reduction of staff turnover and improvement of morale. Maureen has written or contributed to the authorship of a wide range of website articles, healthcare journals and in the creation of online educational content. She is also a prolific fiction author. Learn more about her freelance writing at CharmedType.com and her fiction books at MaureenBonatch.com

Healthcare payment and financing solution

The CareCredit health and wellness credit card helps improve the payment experience for patients and clients, and your financial performance.

Get StartedReady to help more patients and clients get the care they want and need?

Get StartedReady to help more patients and clients get the care they want and need?

Get StartedThis content is subject to change without notice and offered for informational use only. You are urged to consult with your individual business, financial, legal, tax and/or other advisors with respect to any information presented. Synchrony and any of its affiliates, including CareCredit, (collectively, “Synchrony”) makes no representations or warranties regarding this content and accept no liability for any loss or harm arising from the use of the information provided. Your receipt of this material constitutes your acceptance of these terms and conditions.